Rollovers

If your business transacts rentals that last more than one month, it's possible to make use of the Rollover feature in RentWorks. Rollover rentals stay open for longer durations, sometimes many months, and allow for the creation of deposit and payment records against them. Invoices or receipts can be created, depending upon the default method of payment selected when the contracts are opened.

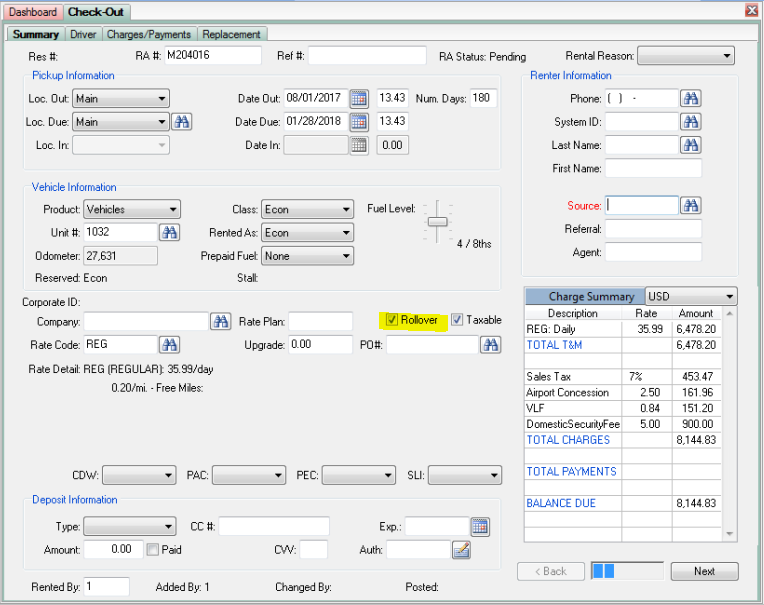

To begin a Rollover rental, simply check the Rollover checkbox on the Summary tab. It's located in the middle of the screen. Please note that the only moment in time to create a Rollover contract is while it's being opened. Currently-opened RA's cannot be converted to Rollovers, nor can a currently-opened Rollover contract be converted to a non-rollover one.

Once you check the box for Rollover, the corresponding Rollover Information Screen icon at the top, ![]() , will be activated.

, will be activated.

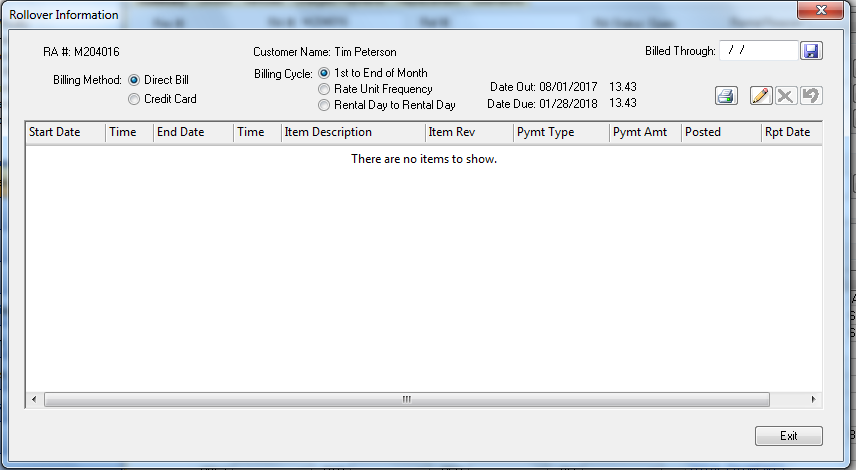

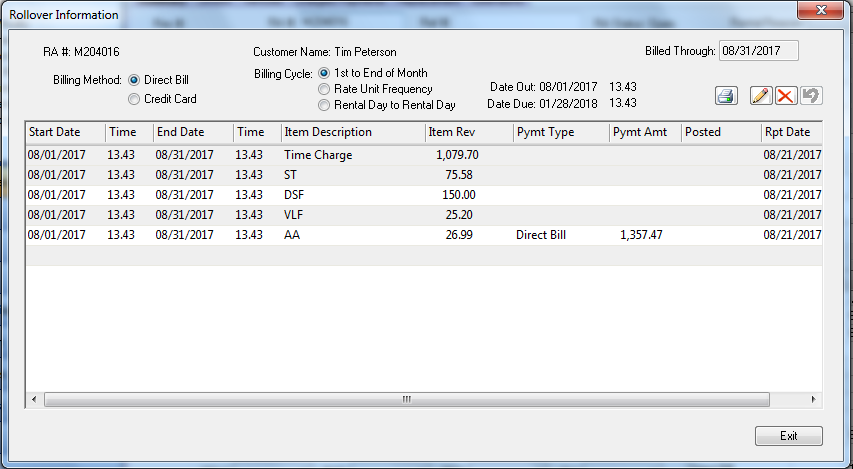

To define the Billing Method and Billing Cycle, click the Rollover Information Screen icon, ![]() , and the following screen will appear:

, and the following screen will appear:

For the Billing Cycle, if you select "1st to End of Month", the monthly rate will be charged each month, regardless of the number of days in the month. The key is that there has to be a rate on the contract that includes a rate line with the Units field set at more than 27 days. The Rollover logic looks at this as being the Monthly rate.

If you need to prorate a partial month, create a daily rate to be 1/30th of the monthly rate.

Note: Once a Rollover contract has been created and saved, you cannot use Contract Modify to change the Billing Method or Billing Cycle.

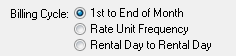

The new Billing Cycle options are below:

The Billing Cycle defaults to 1st to End of Month. The default can be changed with the use of Custom Features R1025 to default to Rate Unit Frequency and A1033 to default to Rental Day to Rental Day. You can also change/override the Billing Cycle on the rollover screen during the creation of the rollover contract.

To charge in 30 day increments, select Rate Unit Frequency on the rollover screen. The billing cycle will be based on the rate on the contract. Therefore, rollover contracts with a monthly rate will cycle on the number of days defined on the rate line for the monthly rate (usually 30 days).

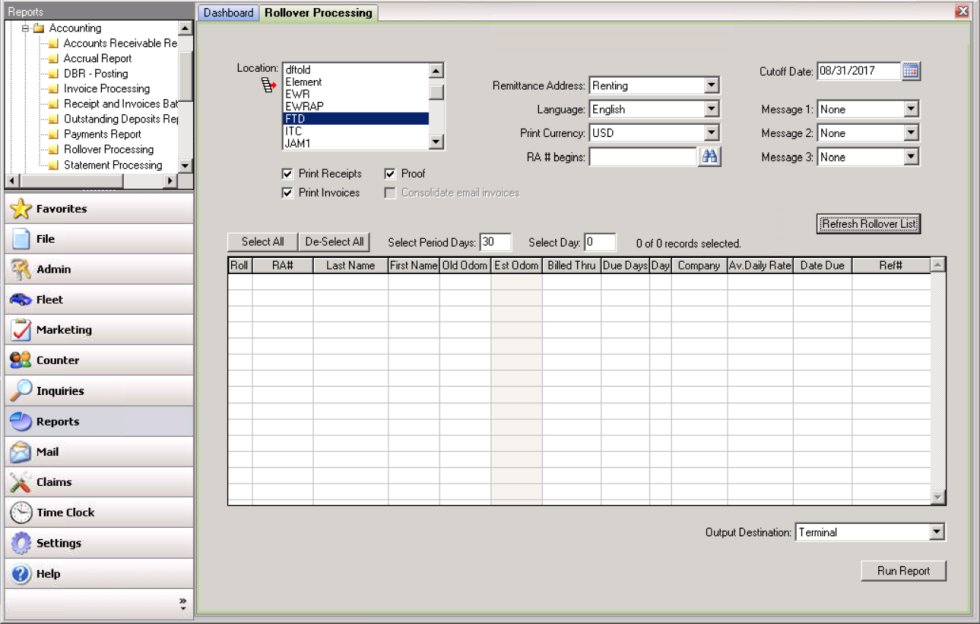

To create the actual Rollover Payments, go to Reports->Management Reports->Accounting->Rollover Processing:

This is run normally once a month, while the Rollover contracts are still open. The cutoff date is typically the last day of the month.

When the box is checked for Consolidate Email Invoices, all the invoices will be sent as a single attachment when going to the same billing company. An email address must exist in the company record to use this feature.

After completion of the report, new payments are created on the contract. Despite the fact that the rollover contracts are still open, these function as true payments (revenue) and not deposits (liabilities).

A separate section of the Daily Business Report (DBR) entitled Booked Revenue Entries will show the rollover revenue accruing to the location within the dates specified when the report is run. This allows operators to distinguish revenue generated by rollover rentals. By default, the Report Date of the rollover entry is the day the Rollover Report is actually run.

All rollover entries viewed on the Rollover Information screen, available as a toolbar icon on the contracts' Sales Information screen, ![]() .

.

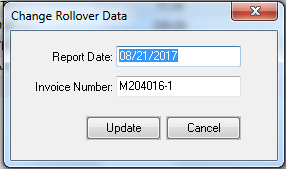

To make any changes to the Report Date or Invoice Number, highlight the entry and click on Change in the upper right:

The most recent Rollover entries may also be deleted here to accommodate any difficulties caused during a run of the report. You can delete as many entries as you want, as long as you start with the most recent ones. Simply highlight the entry and click on Delete in the upper right.

As Rollover contracts are being closed, the Rollover payments are netted out of the balance owing and any outstanding amounts are settled on the payments page in the usual manner. The DBR will show only the final Rollover amount accruing on that day and a few extra lines to indicate the Rollover aspects of the revenue are added below the regular revenue lines in the Closed Contracts section of the DBR.

The Taxes and Fees Report breaks out the taxes produced during previous rollover processing sessions as separate line items below the master listing for the rental agreement. This allows operators to calculate only the tax owing for the given revenue period.

Additional Notes:

- If you are doing “Monthly” time and mileage rates, you should be doing “monthly” rates on charges and coverages as well. When you mix the two, you get mixed results. For the month of June, RentWorks has calculated 29 days for the CDC charge since it ONLY has a daily charge, but a monthly (30 days) for the rate.

- The same RA number is maintained for the life of the rollover contract. The invoices generated by the Rollover process will have a -1, -2, etc. appended to them. This will allow you to keep track of which invoices are for which months.

- The dates on the contract will remain the same. The exchange process will look at the current vehicle on the contract for the dates/times for any exchanges. Exchanges do NOT look at contract dates/time.

- To see accrued revenue from rollovers, use the Revenue Management Report. Click on Choose Columns to Print. On the pop-up screen, select how you want to report on Accrued Income. Choices are: As-Of Date OR Due Date.

- One time charges can now be added to rollovers. These charges can only be flat rate charge types.