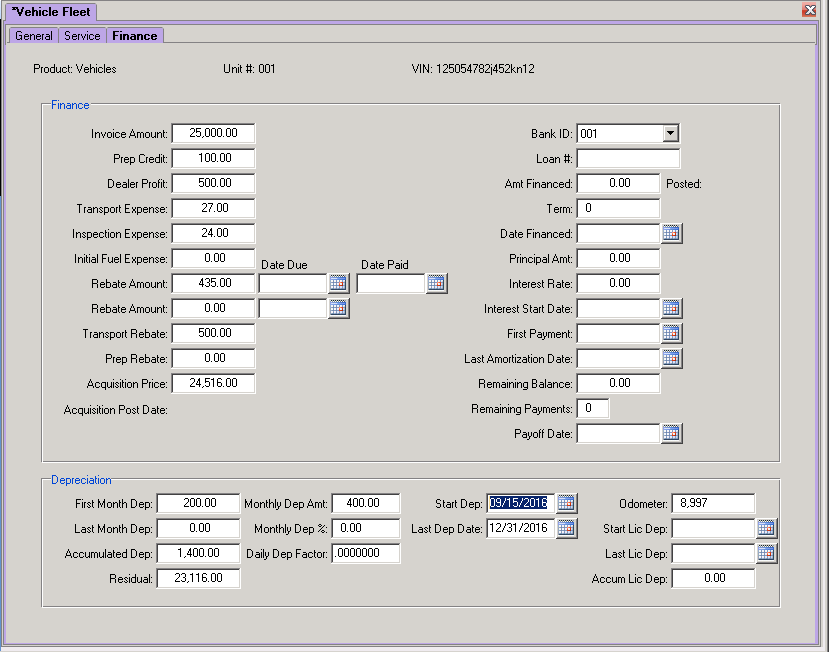

Vehicle Fleet Finance Tab

Finance

Invoice Amount - The amount for which you were invoiced for this vehicle.

Acquisition Price - Purchase Price of the vehicle (VLF won’t calculate without an acquisition price.) If the invoice amount is zero but the acquisition price is not zero, the invoice amount becomes the acquisition price. Otherwise, the invoice amount retains its current value.

The Acquisition Price is calculated as follows:

- Invoice Amount +

- Dealer Profit +

- Purchase Transport Expense +

- Inspection Expense +

- Initial Fuel Expense

- minus

- Prep Credit

- Rebate Amount 1

- Rebate Amount 2

- Transport Rebate

- Prep Rebate

Bank ID - Use the pull-down menu to select a Financial Institution.

Loan# – Loan number.

Amt Financed -

Posted - The date that the acquisition price was posted using the Fleet Additions Report.

Term – The term of the loan.

Date Financed – Date of financing.

Principal Amt - Principal Amount.

Interest Rate – Interest rate percentage.

Interest Start Date

First Payment – First payment date.

Last Amortization Date

Remaining Balance

Remaining Payments – Number of remaining payments.

Payoff Date – The date that the loan is paid off.

Depreciation

These fields contain the vehicle’s depreciation information. You can depreciate a vehicle on a monthly basis by a fixed amount or percentage, or you can depreciate by a daily percentage. The Fleet Depreciation ReportDepreciation_Report is used to update these values.

First Month Dep – First month’s depreciation. Enter the amount here if it should be DIFFERENT from what the system would calculate. For example, if you depreciate your vehicles by 2% per month, and the acquisition price is 20,000, the monthly depreciation would normally be $400 per month. But if you do not start depreciating until the middle of the first month, enter $200 in this field.

Last Month Dep – Last month’s depreciation. Enter the amount here if it should be DIFFERENT from what the system would calculate. For example, if you depreciate your vehicles by 2% per month, and the acquisition price is 20,000, the monthly depreciation would normally be $400 per month. But if you will depreciating just until the middle of the first month, enter $200 in this field.

Accumulated Dep – Accumulated depreciation. You can either let the system calculate this for you from day one, or enter an accumulated amount.

Residual – Residual amount. Note that the Acquisition Price will automatically fill in this amount.

Depreciation can be calculated in one of three ways. You can fill in only one of the following three fields:

- Mo Dep Amt – Monthly (flat) depreciation amount.

- Mo Dep% – Monthly depreciation percentage.

- Daily Dep% – Daily depreciation percentage.

Start Dep – The date on which depreciation starts. Note that if it is not the first of the month, and you use a monthly flat amount or percentage, you should enter a value in the "First Month Dep" field.

Last Dep Date – The last day that the vehicle was depreciated. Note that if it is not the first of the month, and you use a monthly flat amount or percentage, you should enter a value in the "Last Month Dep" field.

Odom – The odometer value at the last depreciation.

Start Lic Dep – Starting date of the license depreciation.

Last Lic Dep – The last day that the license was depreciated.

Accum Lic Dep – Accumulated license depreciation.